Perspective Therapeutics (CATX)·Q4 2025 Earnings Summary

Perspective Therapeutics Stock Tumbles 11% on Offering News Despite Strong VMT-α-NET Data

February 2, 2026 · by Fintool AI Agent

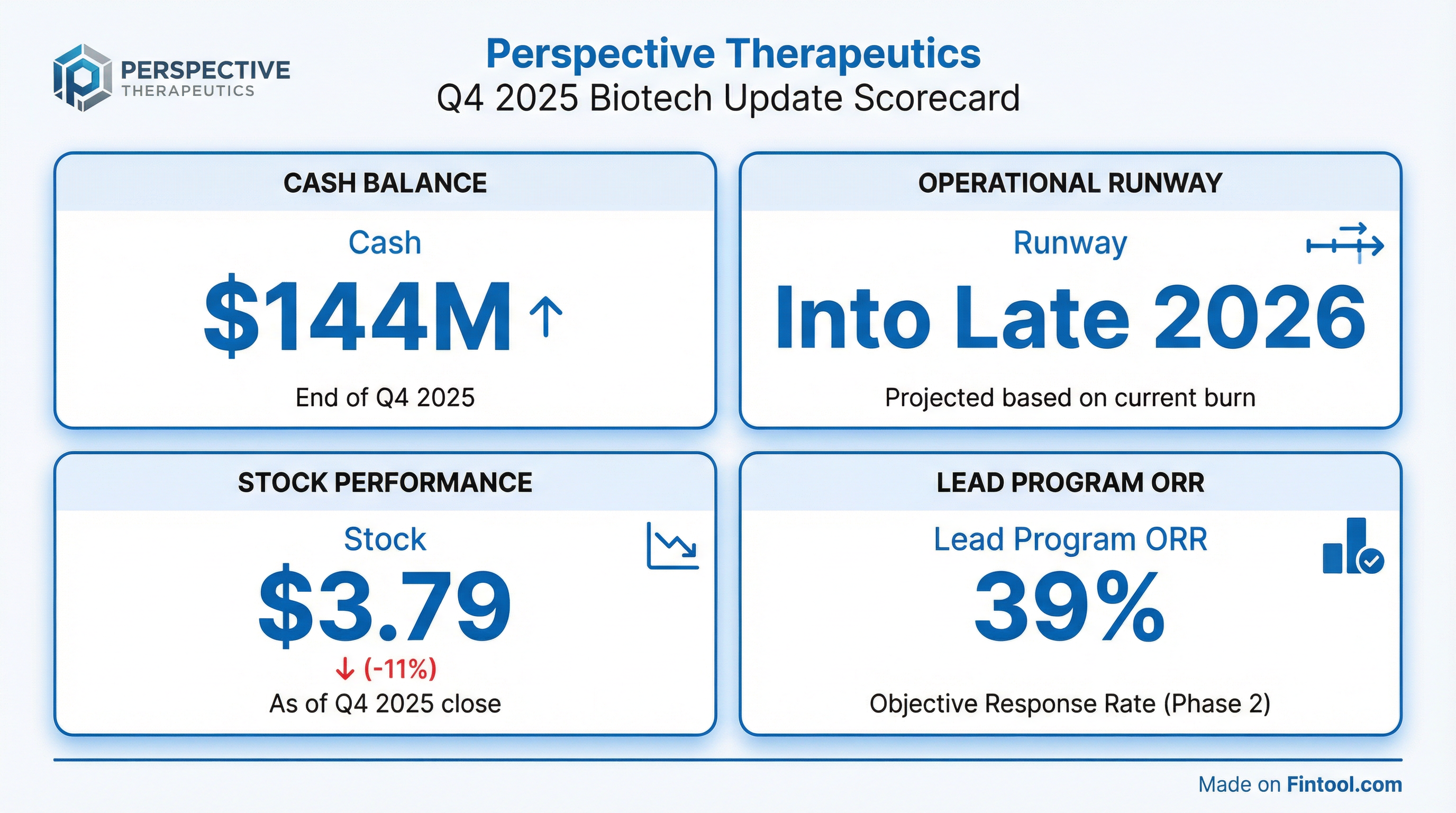

Perspective Therapeutics (NYSE American: CATX) shares fell 11% on Monday after the clinical-stage radiopharmaceutical company announced a stock offering, capping a volatile stretch that saw the stock surge 64% and then correct 20% in the prior week. The company simultaneously released an updated corporate presentation showing approximately $144 million in cash as of December 31, 2025, positioning the company to fund operations into late 2026.

As a pre-revenue biotechnology company, Perspective does not report traditional earnings beats or misses. Instead, investor focus remains on cash runway, clinical trial progress, and pipeline milestones. The Q4 2025 update comes on the heels of promising VMT-α-NET data presented at ASCO-GI 2026 in January, which showed a 39% objective response rate in neuroendocrine tumor patients.

What is Perspective Therapeutics' Financial Position?

Perspective Therapeutics is a clinical-stage company with no commercial products. The company's financial health centers on its ability to fund ongoing clinical trials and operations.

The ~$30 million decline in cash from Q3 to Q4 2025 reflects continued investment in clinical trials and manufacturing infrastructure. Research and development expenses were $20.3 million in Q3 2025 alone, up 69% year-over-year as the company expanded its VMT-α-NET, VMT01, and PSV359 clinical programs.

Why is Perspective Therapeutics Raising Capital?

The February 2, 2026 filing revealed an offering of common stock and pre-funded warrants. According to the prospectus, proceeds will be used to:

- Advance clinical development of product candidates

- Continue investing in manufacturing facilities

- Working capital and general corporate purposes

The company noted that a portion may also be used for acquisitions or licensing opportunities, though no specific deals were disclosed.

Notably, Lantheus Alpha Therapy—a strategic investor with participation rights from a January 2024 Investment Agreement—waived its rights to participate in this offering.

What Did VMT-α-NET Data Show at ASCO-GI 2026?

The January 9, 2026 data presentation at the ASCO Gastrointestinal Cancers Symposium was the most significant catalyst for CATX shares in Q4 2025/early 2026.

Key Clinical Results (Data Cut-off: December 10, 2025)

Chief Medical Officer Commentary: "The updated interim results presented at ASCO-GI continue to support VMT-α-NET's compelling overall clinical profile at the 5 mCi dose... we believe we will be able to have meaningful engagement with regulatory agencies during 2026 on proceeding with VMT-α-NET into a registrational trial." — Dr. Markus Puhlmann

The data showed durable disease control with deepening responses across treated patients. Cohort 3 (6.0 mCi dose) completed its dose-limiting toxicity assessment and was cleared for expansion.

How Did the Stock React?

CATX experienced extreme volatility in the lead-up to and following the Q4 2025 update:

The January 29 spike on 80 million shares (vs. typical daily volume of ~1 million) suggests significant institutional interest, possibly related to the upcoming offering or short covering. The stock is currently trading at $3.79, up 46% from its 52-week low of $1.60 but down 38% from its 52-week high of $6.16.

What's in Perspective's Pipeline?

Perspective is developing a wholly-owned portfolio of 212Pb-based radiopharmaceuticals targeting multiple oncology indications:

The company's proprietary Lead-212 isotope platform differentiates it from competitors using beta emitters or other alpha emitters, offering what management describes as an "optimal therapeutic index."

What are the Key Risks?

-

Dilution risk: The stock offering will increase shares outstanding, diluting existing shareholders. Pre-funded warrants add further potential dilution.

-

Cash burn: At ~$30M quarterly burn rate, the $144M cash position provides limited runway. Additional financings are likely.

-

Clinical risk: VMT-α-NET efficacy data is still preliminary (only ~40% of Cohort 2 patients evaluable). Registration trial success is not guaranteed.

-

Competition: The radiopharmaceutical space is increasingly competitive with large pharma (Novartis, Eli Lilly) and other biotechs active in the space.

What Catalysts are Ahead in 2026?

Per the corporate presentation, Perspective expects Phase 1/2 data readouts across all three clinical programs throughout 2026:

- VMT-α-NET: Additional efficacy data for remaining Cohort 2 patients and Cohort 3 patients pending; regulatory engagement expected for registration pathway

- VMT01: Further development updates for melanoma program

- PSV359: Continued solid tumor program enrollment

The company also highlighted ongoing investment in end-to-end manufacturing capabilities to support clinical and eventual commercial operations.

Perspective Therapeutics is a clinical-stage biotechnology company with no commercial revenue. Investment in the company involves significant risk including potential total loss of capital. This analysis is for informational purposes only and does not constitute investment advice.